Current Foreign Retaliatory actions

Reciprocal Tariff Rates Modified -- Trade Alert

On August 1, 2025, President Trump signed an executive order (EO) imposing “reciprocal” tariffs ranging from 10% to 41% on imports from dozens of countries. This order came after a period of trade negotiations and threats of tariffs leading up to a self-imposed August 1 deadline.

Key aspects of the EO and related actions include:

Reciprocal Tariffs: The tariffs are described as “reciprocal” because they are designed to match the duties other nations impose on U.S. goods. The new rates were codified in Annex I of the EO and apply to over 60 trading partners.

Delayed Implementation (Mostly): While the original deadline for these tariffs was August 1, 2025, the implementation for most countries has been pushed back to August 7, 2025.

Baseline and Higher Rates: The EO sets a baseline minimum tariff rate of 10% for most trading partners. However, countries with which the U.S. has a trade deficit face a higher starting rate of 15%.

Specific Country Tariffs:

- Canada: Imports from Canada face a 35% tariff, increased from 25%, effective August 1st. This increase was cited as a response to Canada’s failure to cooperate in curbing fentanyl trafficking and retaliation against previous U.S. actions.

- Brazil: Brazil’s goods face a 10% reciprocal tariff, but an additional 40% levy, effective August 1st, was imposed due to the prosecution of its former president, Jair Bolsonaro, bringing the total to 50%.

- European Union: For goods with a Column 1 Duty Rate of the HTSUS of less than 15%, the sum of its Column 1 Duty Rate and the reciprocal tariff should be 15%. While goods with a Column 1 Duty Rate greater than 15% are subject to a 0% reciprocal tariff.

- India: India’s US-bound exports will face a 25% tariff.

- Switzerland: Switzerland faces a 39% tariff.

- New Zealand: Exports from New Zealand to the U.S. are subject to a 15% tariff.

- Bangladesh: Bangladesh will face a 20% tariff on its goods.

- China: The EO outlines rates for many trading partners, but China’s tariffs will continue to incur separate duties.

- Mexico: Trade talks between the U.S. and Mexico are extended for 90 days, pushing back the original August 1 deadline when a 30% tariff was set to take effect.

- Transshipment: Articles transshipped to evade these additional duties will be subject to (i) a 40% tariff in lieu of the applicable duty rate listed in Annex I of the EO, (ii) any other applicable or appropriate fine or penalty, and (iii) any other duties, fees, taxes, exactions, or charges applicable to goods of the country of origin.

This EO represents a significant shift in U.S. trade policy, replacing a temporary suspension of tariffs with a system based on “reciprocal” rates for various trading partners.

Braumiller Law Group PLLC will continue to monitor negotiation progress and provide updates as needed.

If you have additional questions, please feel free to reach out to Adrienne Braumiller at Adrienne@Braumillerlaw.com.

Tariff Updates (Dec. 11, 2024 – April 15, 2025)

Clarification of Reciprocal Tariff Exception for Semiconductors

On April 11, 2025, President Trump released a memorandum clarifying the “semiconductors” exception to the reciprocal tariffs imposed on April 2, 2025. That term’s meaning includes the products classified in the following headings and subheadings of the Harmonized Tariff Schedule of the United States (HTSUS):

- 8471

- 847330

- 8486

- 85171300

- 85176200

- 85235100

- 8524

- 85285200

- 85411000

- 85412100

- 85412900

- 85413000

- 85414910

- 85414970

- 85414980

- 85414995

- 85415100

- 85415900

- 85419000

- 8542

Restoring America’s Maritime Dominance Executive Order

On April 9, 2025, President Trump signed an Executive Order (EO), “Restoring America’s Maritime Dominance,” that focuses on the revitalizing and rebuilding of the U.S maritime industry and workforce to promote national security and economic prosperity. The EO directs several agencies to develop various reports, proposals, and plans. A main component is the establishment of a Maritime Action Plan (MAP), which tasks the Assistant to the President for National Security Affairs (APNSA), Secretary of State, the Secretary of Defense, the Secretary of Commerce, the Secretary of Labor, the Secretary of Transportation, the Secretary of Homeland Security, the United States Trade Representative (USTR), and the heads of executive departments and agencies (agencies) the APNSA deems appropriate, to develop a comprehensive strategy for all subsequent executive and legislative actions.

Additionally, the EO focuses on preventing cargo carriers from circumventing the Harbor Maintenance Fee (HMF) on imported goods through the practice of making port in Canada or Mexico and sending their cargo into the U.S. through land borders. Furthermore, based on the USTR’s Section 301 Investigation of China’s Targeting of the Maritime, Logistics, and Shipbuilding Sectors for Dominance, the EO directs the USTR to consider taking all necessary steps permitted by law to propose:

- Tariffs on ship-to-shore cranes manufactured, assembled, or made using components of PRC origin, or manufactured anywhere in the world by a company owned, controlled, or substantially influenced by a PRC national; and

- Tariffs on other cargo handling equipment.

Other key initiatives in the EO include:

- The Secretary of Defense shall provide an assessment of options both for the use of available authorities and resources, such as Defense Production Act Title III authorities, and for the use of private capital to the maximum extent possible to invest in and expand the Maritime Industrial Base including, but not limited to, investment and expansion of commercial and defense shipbuilding capabilities, component supply chains, ship repair and marine transportation capabilities, port infrastructure, and the adjacent workforce

- The OMB Director shall deliver a legislative proposal to establish a Maritime Security Trust Fund that can serve as a reliable funding source to deliver consistent support for MAP programs

- The Secretary of State shall deliver a report with recommendations to address workforce challenges in the maritime sector through maritime educational institutions and workforce transitions

We will continue to monitor any new developments and updates as agencies deliver their respective reports and proposals. If you are concerned about how these actions may impact your business, please contact Bob Brewer at Bob@braumillerlaw.com or Adrienne Braumiller at Adrienne@braumillerlaw.com.

Reciprocal Tariff Rates Modified to Reflect Trading Partner Retaliation and Alignment

On April 9, 2025, President Trump paused higher country-specific ad valorem rates of duty until July 9, 2025. During the pause, those trading partners will now be subject to an additional ad valorem rate of duty of 10%.

This modification does not apply to China. Rather, the reciprocal tariff on imports from China and Hong Kong will increase from 84% to 125%. Other actions include:

- Increased the ad valorem rate of duty from 90% to 120%

- Increased the per postal item containing goods duty, that goes into effect on May 2, 2025, from $75 to $100

- Increased the per postal item containing goods duty, that goes into effect on June 1, 2025, from $150 to $200

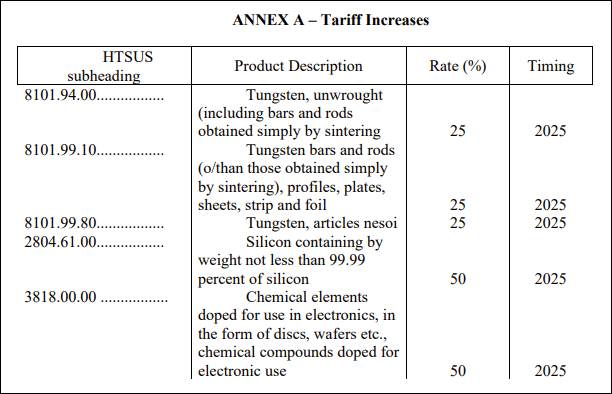

USTR Increases Tariffs Under Section 301 on Tungsten Products, Wafers, and Polysilicon

On December 11th, the United States Trade Representative announced additional Section 301 tariff increases on Chinese tungsten products, wafers, and polysilicon. The tungsten products will increase to a total of 25% tariff while the solar wafers and polysilicon will increase to a total of 50% tariff. Both of these changes will take effect on January 1, 2025. Here is a chart that outlines the impacted HTS codes as well as a product description:

For additional information relating to the increase in Section 301 tariffs for these products, see https://ustr.gov/sites/default/files/Section%20301%20FRN%20for%20Modifications%20for%205%20Additional%20Subheadings%20-%20Final%20Rev.pdf.

If you have further questions regarding how these increased Section 301 tariffs impact your company, please contact Bob Brewer at Bob@Braumillerlaw.com.

Section 301: Procedures for Requests to Exclude Certain

Machinery Used in Domestic Manufacturing

On October 15, 2024, the United States Trade Representative (USTR) formally opened a process to request a temporary exclusion for certain machinery used in domestic manufacturing. Here is a link to the most recent FR notice:https://www.federalregister.gov/documents/2024/10/17/2024-23880/procedures-for-requests-to-exclude-certain-machinery-used-in-domestic-manufacturing-from-actions.

A complete list of subheadings eligible for the exclusion process can be found within Annex E of this FR Notice:https://www.federalregister.gov/documents/2024/09/18/2024-21217/notice-of-modification-chinas-acts-policies-and-practices-related-to-technology-transfer.

If an importer is successful with an exclusion request, they can avoid paying the additional Section 301 duties. When submitting an exclusion request, requestors are required to submit the following information:

▸ The 10-digit subheading of the HTSUS applicable to the manufacturing equipment requested for exclusion.

▸ A complete and detailed description of the manufacturing equipment.

▸ Whether the manufacturing equipment of concern is subject to an antidumping or countervailing duty order issued by the U.S. Department of Commerce.

▸ Whether the manufacturing equipment will be used for domestic manufacturing, how the equipment will be used, and the manufacturing sector.

▸ If applicable, documents showing grant funding from, or grant application to, a federal investment program related to the domestic manufacturing at issue.

▸ Whether the manufacturing equipment of concern, or comparable manufacturing equipment, is available from sources in the United States or third countries and any attempts of the requesting organization to source the manufacturing equipment from the United States or third countries.

▸ Whether the requesting organization has purchased the manufacturing equipment of concern from a source in the United States or in a third country in the past five years and why the manufacturing equipment is no longer available from this source.

▸ Whether the manufacturing equipment of concern is strategically important or related to “Made in China 2025” or other Chinese industrial programs.

Exclusion requests will be accepted through March 31, 2025, on the USTR Comment Portal (https://comments.ustr.gov/s/). If successful, any exclusion will be effective starting from the date of publication of the exclusion determination in the Federal Register and will extend through May 31, 2025.

It is likely that the USTR would consider extending certain approved exclusions at that time.

It is more important now than ever to request an exclusion if your Company qualifies. Recently, Trump has stated that he intends to add an additional tariff on Chinese imports in excess of 60%. This would be a major increase from tariffs that were imposed during his first term as President. In addition to this 60% tariff on Chinese goods, Trump has also indicated that he plans to impose a 10% across-the-board tariff on all products imported into the U.S. from overseas. We will continue to monitor these tariff developments and provide additional information as it becomes available.

Announcing Final Determinations of Aluminum Extrusions Investigations

Today the U. S. Department of Commerce announced affirmative final determinations in the AD and CVD investigations of aluminum extrusions from the People’s Republic of China (China), Colombia, Ecuador, India, Indonesia, Italy, Malaysia, Mexico, the Republic of Korea (Korea), Taiwan, Thailand, the Republic of Türkiye (Türkiye), the United Arab Emirates (UAE), and the Socialist Republic of Vietnam (Vietnam), and CVD investigations of aluminum extrusions from China, Indonesia, Mexico, and Türkiye.

Please see the attached Enforcement and Compliance Fact Sheet for details on this important update and contact BLG with any questions or for any further assistance.

Summary of the Findings of the USTR Four-Year Review of Actions Taken in the Section 301 Investigation

USTR OPENING SECTION 301

COMMENT PERIOD

On May 22nd, the United States Trade Representative (USTR) released the following FR Notice USTR FRN Four Year Review Proposed Modifications fin.pdf. This FR Notice came as a result of the Section 301 report that was released earlier last week. In the report, the USTR indicated that President Biden has directed the agency to take a number of actions as a result of China’s unfair trade practices. These actions are a direct result of the four-year statutory review by the USTR.

Within the FR Notice, the proposed actions by the USTR include the following:

- Modifying the actions by adding or increasing section 301 ad valorem rates of duty, as directed by the President, for certain products of China in strategic sectors.

- Opening a sub-headings eligible for an exclusion process by which interested persons may request that particular machinery used in domestic manufacturing be temporarily excluded from section 301 tariffs.

- Modifying the actions by granting 19 temporary exclusions for certain solar manufacturing equipment.

Based on these proposals, interested parties can comment on the following:

- The effectiveness of the proposed modification in obtaining the elimination of or in counteracting China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation.

- The effects of the proposed modification on the U.S. economy, including consumers.

- The scope of the product description to cover ship-to-shore cranes under subheading 8426.19.00 (Transporter cranes, gantry cranes and bridge cranes).

- With respect to facemasks, medical gloves, and syringes and needles, whether the tariff rates should be higher than the proposed rates.

- With respect to facemasks, whether additional statistical reporting codes under tariff subheading 6307.90.98 should be included.

- Whether the tariff subheadings identified for each product and sector adequately cover the products and sectors included in the President’s direction to the Trade Representative.

- With respect to the exclusion process, USTR seeks comments on whether the subheadings listed in Annex B should or should not be eligible for consideration in the machinery exclusion process and whether Annex B omits certain subheadings under Chapters 84 and 84 that cover machinery used in domestic manufacturing and should be included.

- With respect to the proposed solar manufacturing machinery exclusions in Annex C, USTR requests comments on the scope of each exclusion, including any suggested amendments to the product description.

The comment period opens on May 29th and closes on June 28th.

Braumiller Law Group, PLLC has extensive experience drafting Section 301 comments for clients. Our firm has a unique understanding of what information should be included in a request to the USTR to give a Company the best chance of success.

Section 301 Litigation Update February 14, 2024

On February 12, 2024, Plaintiff-Appellants in the Section 301 litigation filed its Reply Brief with the Court of Appeals for the Federal Circuit seeking to reverse the CIT’s initial judgement in favor of the government. In that reply brief, the Plaintiff argues that the Administrative Procedure Act (“APA”), which establishes the procedural requirements for “notice-and-comment rulemaking”, was not followed and that a robust investigation prior to the USTR implementing Section 301 List 3 and List 4a was required. Further, the Plaintiff maintains that the government did not provide contemporaneous evidence that it grappled with public comments at the time it developed List 3 and 4a.

We anticipate it will be 60-90 days before oral arguments are presented to the Court of Appeal Justices.

For questions regarding Section 301 litigation and exclusions, or other customs and trade related matter, please contact us: bob@braumillerlaw.com

On December 29, 2023, the United States Trade Representative issued Federal Register Notice (FR 88 90225), Extension of Exclusions and Request for Comments: China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property and Innovation.

On December 29, 2023, the United States Trade Representative issued Federal Register Notice (FR 88 90225), Extension of Exclusions and Request for Comments: China’s Acts, Policies and Practices Related to Technology Transfer, Intellectual Property and Innovation. The FR Notice indicated that the USTR determined to extend 352 previously reinstated exclusions and 77 COVID related exclusions for five months, through May 31, 2024. However

China Section 301 Duties:

Understanding the Statutory Four-Year Review Period of the Tariffs

99 Section 301 (China)

COVID-Related Exclusions Extended!

November 11, 2021

On November 9, 2021 the USTR announced the extension of the 99 COVID-related exclusions. The first group of 18 HTS subheadings was set to expire on November 14, 2021 and has the expiration date extended until November 30, 2021 at 11:59pm. The second group of 81 HTS subheadings, which was set to expire on November 14, 2021, has been extended until May 31, 2022 at 11:59pm.

- HTS subheadings extended until 11/30/2021 (see product descriptions for specific language): 3401.30.5000; 3808.94.5050; 3808.94.5090; 3919.90.5060; 3926.20.9010; 4015.19.0510; 4015.19.0550; 4015.19.1010; 5603.12.0090; 6116.10.6500; 6307.90.6090; 6307.90.6800; 6307.90.9889; 6307.90.9845; 6307.90.9850; 6307.90.9870; 6307.90.9889; 6307.90.9845; 6307.90.9850; 6307.90.9870 or 6307.90.9875; 6307.90.9889; 6307.90.9890.

- HTS Subheadings extended until 05/31/2022 (see product descriptions for specific language) : 2805.11.0000; 3401.19.0000; 3401.30.5000; 3808.94.1000; 3808.94.5010; 3824.99.9297; 3917.29.0090; 3917.33.0000; 3920.10.0000; 3921.19.0000; 3921.90.1500; 3923.10.9000; 3923.21.0030; 3923.21.0095; 3923.50.0000; 3926.20.9050; 3926.90.9910; 3926.90.9990; 3926.90.9985; 4818.90.0000; 4818.90.0020; 4818.90.0080; 4819.50.4060; 5210.11.4040; 5210.11.6020; 5504.10.0000; 5603.12.0090; 5603.14.9090; 5603.92.0090; 5603.93.0090; 6210.10.5010; 6210.10.5090; 6307.90.7200; 6307.90.9889; 6307.90.9891; 6307.90.9889; 6307.90.9891; 6505.00.8015; 8413.20.0000; 8421.39.8090; 8424.89.9000; 8424.90.9080; 8531.20.0040; 8537.10.9170; 8543.10.0000; 9004.90.0000; 9011.80.0000; 9018.11.9000; 9018.12.0000; 9018.19.9550; 9018.19.9560; 9018.90.2000; 9018.90.3000; 9018.90.6000; 9018.90.7580; 9022.12.0000; 9022.90.2500; 9022.90.4000; 9022.90.6000; 9022.90.9500; 9025.19.8010; 9025.19.8020; 9025.19.8060; 9025.19.8085; 9027.90.5650.

These HTS subheadings are exempt under a new Chapter 99 designation of 9903.88.66, along with a new U.S. Note 20(sss)(i) through (sss)(iv) depending on which original list the HTS number was contained in: U.S. Note 20(sss)(i) is List 1; U.S. Note 20(sss)(ii) is List 2; U.S. Note 20(sss)(iii) is List 3 and U.S. Note 20(sss)(iv) is List 4A.

A complete listing of the status of the 99 COVID-related exclusions, the Section 301 duty rate and individual HTS U.S. Note 20 designations can be found here.

If you have questions about filing an exclusion request, seeking a refund of past duties paid under Sec. 301, and/or discussing Sec. 301 duty avoidance strategies, such as use of Country of Origin transference or use of “First Sale” valuation, contact bob@braumillerlaw.com

The information in this article is general in nature and is not intended to constitute legal advice or to create an attorney-client relationship with respect to any event or occurrence and may not be considered as such.

Doing Business In & Trading with China

Proposed Section 301 Duties for Imports From Select Countries

April 1, 2021

On March 31st, 2021 in the Federal Register, the Office of the Federal Trade Representative (USTR) proposed new Section 301 duties in response to increased Digital Services Taxes (DSTs) enacted by the United Kingdom, Austria, Italy, Spain, Turkey and India. The USTR is inviting comment from the import community on the proposed Section 301 duties of up to 25%. Comments are due by April 30, 2021.

The merchandise subject to the proposed Section 301 duties differs between each country of export. The proposed duties cover imports including various food stuffs, clothing, high tech merchandise and optics. Below are links to the individual Federal Register notices, which list the specific tariffs for merchandise imported from each country that the USTR proposes should be subject to the Section 301 duties.

• Austria

• Italy

• Spain

• United Kingdom

• India

• Turkey

If you have questions about filing a court action on the List 3 or List 4A exclusions, seeking a refund of past duties paid under Sec. 301, and/or discussing Sec. 301 duty avoidance strategies, such as use of country of origin transference or use of “First Sale” valuation, contact, Adrienne Braumiller, adrienne@braumillerlaw.com

At this point, the majority of Section 301 exclusions have expired as of 12/31/2020. Importers who had previously utilized a List 3 exclusion likely began paying tariffs on January 1, 2021. However, there are some exclusions that are currently still in play:

- Certain List 1 exclusions that were extended one year (before December 31, 2020 became the general expiration date):

- Certain COVID-19 exclusions that are valid through March 31, 2021:

- https://ustr.gov/sites/default/files/enforcement/301Investigations/COVID_Extensions_December_2020.pdf https://www.tuttlelaw.com/newsletter_links/turkey_21.pdf

Section 301 China Exclusion Extensions Issued September and October

October 7, 2020 A. List 1 – $34 Billion Exclusions Extended B. List 2 – $16 Billion Exclusions Extended Exclusion List Updated as of October 7, 2020A. List 1 – $34 Billion Exclusions Extended

1. Exclusions Expired September 20, 2020 On September 22, 2020 the USTR (85 FR 59587) announced 62 extensions for exclusions originally ending on September 20, 2020. These product exclusion extensions will apply as of that date and extend through December 31, 2020. Importers, brokers and filers are advised to use HTS 9903.88.58 when entering merchandise. Merchandise that did not receive an exclusion will revert to Chapter 9903.88.01 at the 25% duty rate. Merchandise receiving the exclusion extensions include submersible centrifugal pumps, tabletop water fountains, animal feeding machinery, tool holders, AC motors, 4-wheeled off road vehicles, anesthesia masks, automatic thermostats and more.2. Exclusions Expired October 2, 2020

On October 5, 2020, the USTR (85 FR 62782) announced 9 extensions for exclusions originally ending on October 2, 2020. These product exclusion extensions will apply as of that date and extend through December 31, 2020. Importers, brokers and filers are advised to use HTS 9903.88.60 when entering merchandise. Merchandise that did not receive an exclusion will revert to Chapter 9903.88.01 at the 25% duty rate. Recent articles related to the filing of cases with the CIT regarding potential Section 301 refunds: Section 301 CIT Litigation: Current Status and What’s Next? October 8, 2020 By: Brandon French, Associate Attorney, BLG https://www.braumillerlaw.com/section-301-cit-litigation-current-status-and-whats-next/ To File or Not to File Protests? October 9, 2020 By: Adrienne Braumiller & Vicky Wu Braumiller Law Group George Tuttle III, Law Offices of George R. Tuttle https://www.braumillerlaw.com/to-file-or-not-to-file-protests/ Filing with the CIT Regarding the Section 301 Potential Tariff Refund October 8, 2020 By: Bob Brewer, Braumiller Law Group https://www.braumillerlaw.com/filing-with-the-cit-regarding-the-section-301-potential-tariff-refund/Section 301 China – Exclusions

Extended & Short Deadline for Exclusions

Expiring May and June 2020

USTR Release New Exclusions for List 4A

On June 8, 2020 the USTR released a new FR Notice that provided additional approved exclusions for List 4A. These exclusions apply retroactive to September 2019, and will expire on September 1, 2020. The exclusions that were granted in this notice include two full 10-digit HTS code and 32 specially crafted provisions.

USTR Opens Process to Request Extension for Exclusions Granted in September 2019 (List 1)

On June 3, 2020, the USTR released a new FR Notice that provided instructions on submitting an extension request for List 1 exclusions that were granted in September 2019. The time period to submit a comment in support (or opposed) of extending an exclusion is June 8th to July 7th. Braumiller Law Group has extensive experience in submitting extension requests to the USTR and will be happy to assist you through this process.

USTR Opens Process to Request Extensions for Exclusions Granted for List 3 (Last Three Notices)

On June 3, 2020, the USTR released a new FR Notice that provided instructions on submitting an extension request for List 3 exclusions that fell on the last 3 Notices. These include exclusions from: 85 FR 23122 (April 24, 2020), 85 FR 27489 (May 8, 2020), and 85 FR 32094 (May 28, 2020). The time period to submit a comment in support (or opposed) of extending an exclusion is June 8th to July 7th. Braumiller Law Group has extensive experience in submitting extension requests to the USTR and will be happy to assist you through this process.

USTR Releases Notice of Extensions for Exclusions Expiring on May 14, 2020 (List 1)

On May 15, 2020, the USTR released the list of exclusions from the May 14th FR Notice that would be extended beyond the current deadline. These exclusions are now valid until December 31, 2020. The exclusions that were extended included two full 10-digit HTS codes, as well as eleven specifically crafted provisions.

USTR Releases New Exclusions for List 4A

On May 13, 2020 the USTR released a new FR Notice that provided additional approved exclusions for List 4A. These exclusions apply retroactive to September 2019, and will expire on September 1, 2020. The exclusions that were granted in this notice include three full 10-digit HTS code and 5 specially crafted provisions.

USTR Releases New Exclusions for List 3

On May 8, 2020 the USTR released a new FR Notice that provided additional approved exclusions for List 3. These exclusions apply retroactive to September 2018, and will expire on August 7, 2020. The exclusions that were granted in this notice include two full 10-digit HTS code and 144 specially crafted provisions.

USTR Opens Process to Request Extensions for Exclusions Granted on List 3 (First Eleven Notices)

On May 6, 2020, the USTR released a new FR Notice that provided instructions on submitting an extension request for List 3 exclusions that fell on the first 11 Notices. These include exclusions from: 84 FR 38717 (August 7, 2019), 84 FR 49591 (September 20, 2019), 84 FR 57803 (October 29, 2019), 84 FR 61674 (November 13, 2019), 84 FR 65882 (November 29, 2019), 84 FR 69012 (December 17, 2019), 85 FR 549 (January 6, 2020), 85 FR 6674 (February 5, 2020), 84 FR 9921 (February 20, 2020), 85 FR 15015 (March 16, 2020), and 85 FR 17158 (March 26, 2020). The time period to submit a comment in support (or opposed) of extending an exclusion is May 1st to June 8th. Braumiller Law Group has extensive experience in submitting extension requests to the USTR and will be happy to assist you through this process.

USTR Releases New Exclusions for List 3

On April 24, 2020 the USTR released a new FR Notice that provided additional approved exclusions for List 3. These exclusions apply retroactive to September 2018, and will expire on August 7, 2020. The exclusions that were granted in this notice include one full 10-digit HTS code and 107 specially crafted provisions.

USTR Opens Process to Request Exclusions for Products Directly Related to the COVID-19 Pandemic

On March 25, 2020, the USTR released a new FR Notice that provided instructions on submitting an exclusion request for items directly related to the COVID-19 outbreak. Each comment must specifically identify the particular product of concern and explain how it relates to the response of the COVID-19 outbreak. If successful, a requestor would not be required to pay Section 301 tariffs on the medically-related product(s). The docket to submit a COVID-19 exclusion request is open until at least June 25, 2020. Braumiller Law Group has experience preparing COVID-19 exclusion requests. If your Company imports medically-related items, feel free to contact us for assistance.

April 10, 2020

April 2019 List 1 Exclusions Extended until 4/18/2021

On April 10, 2020 the USTR published in the Federal Register (85 FR 20333) eight LIST 1 items that were granted exclusion extensions to the Section 301 duties levied on goods. These extensions are effective for goods entered from July 6, 2018 and before April 18, 2021.

Below is a comprehensive list of the items along with their HTS numbers:

HTS # | Heading / Subheading | HTS Description | List |

| 8420.10.9080 | Product Specific | Roller machines designed for cutting, etching or embossing paper, foil or fabric, manually powered (described in statistical reporting number 8420.10.9080) | 1 |

| 8425.39.0100 | Product Specific | Ratchet winches designed for use with textile fabric strapping (described in statistical reporting number 8425.39.0100) | 1 |

| 8431.20.0000 | Product Specific | Counterweight castings of iron or steel designed for use on fork lift and other works trucks (described in statistical reporting number 8431.20.0000) | 1 |

| 8431.20.0000 | Product Specific | Tines, carriages, and other goods handling apparatus and parts designed for use on fork lift and other works trucks (described in statistical reporting number 8431.20.0000) | 1 |

| 8479.90.9496 | Product Specific | Reject doors, pin protectors, liners, front walls, grates, hammers, rotor and end disc caps, and anvil and breaker bars, of iron or steel, the foregoing parts of metal shredders (described in statistical reporting number 8479.90.9496) | 1 |

| 8479.90.9496 | Product Specific | Steering wheels designed for watercraft, of stainless steel, having a wheel diameter exceeding 27 cm but not exceeding 78 cm (described in statistical reporting number 8479.90.9496) | 1 |

| 8481.90.9040 | Product Specific | Pipe brackets of aluminum, each with 4 ports, the foregoing measuring 27.9 cm x 20.3 cm x 17.8 cm and weighing 11.34 kg, designed for installation into air brake control valves (described in statistical reporting number 8481.90.9040) | 1 |

| 9030.33.3800 | Product Specific | Instruments for measuring or checking voltage or electrical connections; electrical circuit tracers (described in statistical reporting number 9030.33.3800) | 1 |

Brokers, importers and other entry filers will continue to use HTS 9903.88.07 for the above exclusion.

Reminder in order to recover duties: If the entries are un-liquidated, a PSC needs to be filed; if the entries are liquidated, a protest needs to be filed within (180) days after the liquidation date to protect the right to receive a refund of duties paid.

Certain Tariffs will No Longer be Subject to an Exclusion Exemption on April 18, 2020

The following HTS numbers will be removed from the exclusion exemption on April 18. Brokers, importers and other filers will revert to for the following:

HTS # | Heading / Subheading | HTS Description | List |

| 8413.19.0000 | Product Specific | Pumps designed for countertop appliances for serving beer, the foregoing that control the level of carbonation by means of sonic waves (described in statistical reporting number 8413.19.0000) | 1 |

| 8421.21.0000 | Product Specific | Water oxidizers and chlorinators (described in statistical reporting number 8421.21.0000) | 1 |

| 8428.33.0000 | Product Specific | Continuous action elevators and conveyors, designed to convey mineral materials (described in statistical reporting number 8428.33.0000) | 1 |

| 8466.93.9885 | Product Specific | Parts of drill sharpening machines (described in statistical reporting number 8466.93.9885) | 1 |

| 8479.90.9496 | Product Specific | Outer shells of hydraulic accumulators, of iron or non-alloy steel, cylindrical with hemispherical heads on each end (described in statistical reporting number 8479.90.9496) | 1 |

| 8479.90.9496 | Product Specific | Parts of mechanical awnings and shades (described in statistical reporting number 8479.90.9496) | 1 |

| 8481.10.0090 | Product Specific | Pressure regulators of brass or bronze, whether high or low inlet type, having a rated flow rate of 55,000 – 150,000 BTU/hr, maximum inlet pressure of 0.17 MPa to 1. 72 MPa, inlet connection with POL or thread type of fitting (described in statistical reporting number 8481.10.0090) | 1 |

| 8481.90.9040 | Product Specific | Push pins and C-poles of steel, designed for use in variable force solenoid valves (described in statistical reporting number 8481.90.9040) | 1 |

| 8482.10.5032 | Product Specific | Ball bearings of a width not exceeding 30 mm (described in statistical reporting number 8482.10.5032) | 1 |

| 8504.90.9690 | Product Specific | Inductor baseplates of aluminum, each with a length measuring 149.20 mm or more but not over 275 mm, with a width measuring 119.40 mm or more but not over 232 mm and with a depth of 10.50 mm or more but not over 19 mm, with a weight of 0.48 kg or more but not over 3.2 kg (described in statistical reporting number 8504.90.9690) | 1 |

| 8515.90.4000 | Product Specific | Parts of soldering irons and soldering machines (described in statistical reporting number 8515.90.4000) | 1 |

| 8536.50.9065 | Product Specific | Motor vehicle gear shift switch assemblies, comprised of a plunger, connector and gear shift lever (described in statistical reporting number 8536.50.9065) | 1 |

| 8536.50.9065 | Product Specific | Pressure switches designed for use in heat pumps and air-conditioning condensers having a rating of 1.90 megapascals or more but not over 4.55 megapascals (described in statistical reporting number 8536.50.9065) | 1 |

Reminder: Exclusions Expiring in May & June

The USTR has accelerated its timeline for requesting the extension of exclusions set to expire on May 14, 2020 and on June 4, 2020.

For exclusions granted in May 2019 and set to expire on May 14, 2020, requests for extensions must be received by April 12, 2020. See 85 FR 12373 of March 2, 2020 for further information.

HTS # Expiring May 14, 2020 | ||

| 8407.21.0040 | 8473.40.1000 | 8526.92.5000 |

| 8421.21.0000 | 8481.10.0090 | 8526.92.5000 |

| 8421.21.0000 | 8481.90.9040 | 8526.92.5000 |

| 8421.21.0000 | 8481.90.9040 | 8529.90.8100 |

| 8421.21.0000 | 8481.90.9040 | 8536.49.0075 |

| 8421.21.0000 | 8481.90.9040 | 8536.50.9035 |

| 8421.39.8015 | 8481.90.9040 | 8536.50.9035 |

| 8421.39.8015 | 8481.90.9040 | 8536.50.9035 |

| 8427.10.4000 | 8481.90.9040 | 8536.50.9040 |

| 8428.33.0000 | 8481.90.9040 | 9011.10.8000 |

| 8428.39.0000 | 8483.50.9040 | 9011.90.0000 |

| 8428.39.0000 | 8501.10.4060 | 9018.20.0040 |

| 8438.80.0000 | 8501.52.8040 | |

| 8438.80.0000 | 8505.90.7501 | |

For exclusions granted in June 2019 and set to expire June 4, 2020, requests for extensions must be received by April 30, 2020. See 85 FR 16181 of March 20, 2020 for further information.

HTS # Expiring June 4, 2020 | ||

| 8404.40.4000 | 8428.90.0290 | 8529.10.4040 |

| 8404.40.4000 | 8428.90.0290 | 8529.90.9900 |

| 8404.40.4000 | 8428.90.0290 | 8536.41.0050 |

| 8411.99.9085 | 8428.90.0290 | 8536.50.9035 |

| 8413.50.0010 | 8429.40.0020 | 8536.50.9035 |

| 8413.50.0070 | 8429.52.1010 | 8536.50.9035 |

| 8413.70.2004 | 8430.10.0000 | 8536.50.9035 |

| 8413.70.2004 | 8431.39.0010 | 8536.50.9035 |

| 8413.70.2004 | 8431.39.0010 | 8536.50.9035 |

| 8413.70.2004 | 8431.39.0010 | 8536.50.9035 |

| 8413.70.2004 | 8431.39.0010 | 8536.50.9035 |

| 8413.70.2004 | 8431.39.0010 | 8536.50.9065 |

| 8413.70.2004 | 8431.39.0010 | 8536.90.4000 |

| 8413.70.2005 | 8431.39.0010 | 8536.90.4000 |

| 8413.70.2090 | 8431.39.0010 | 8536.90.4000 |

| 8413.91.9010 | 8431.49.9010 | 8536.90.4000 |

| 8413.91.9010 | 8455.22.0000 | 8536.90.4000 |

| 8413.91.9060 | 8455.22.0000 | 8536.90.4000 |

| 8413.91.9060 | 8482.10.5060 | 8536.90.4000 |

| 8414.90.4190 | 8482.40.0000 | 8536.90.4000 |

| 8418.69.0110 | 8482.99.0500 | 8536.90.4000 |

| 8418.69.0180 | 8482.99.6595 | 8536.90.4000 |

| 8418.69.0180 | 8483.90.8010 | 8536.90.4000 |

| 8419.19.0040 | 8501.53.8040 | 8536.90.4000 |

| 8419.40.0080 | 8504.40.4000 | 8537.10.8000 |

| 8419.90.3000 | 8504.90.6500 | 8543.30.9040 |

| 8421.99.0080 | 8504.90.6500 | 9018.19.9560 |

| 8421.99.0080 | 8504.90.6500 | 9018.19.9560 |

| 8427.10.8090 | 8504.90.6500 | 9018.19.9560 |

| 8525.60.1050 | 9024.10.0000 | |

Courtesy of Tuttle Law Office

Update on China Section 301 Duties: New Exclusions Granted for List 3 and 4A

Time to Apply for Exclusion Extensions Granted June 2019

March 31, 2020

New List 3 Exclusions

The USTR published a list of 176 subheadings available for List 3 exclusions. See Federal Register on March 26, 2020 (85 FR 17158). Additionally the Federal Register notice lists 5 exclusions added to HTS 9903.88.37 (U.S. Note 20(pp) as originally published 85 FR 549 of 1/6/2020).

Included in the excluded items are seeds, chemicals, textile materials, band-saws, hydraulic jacks, parts of suspension systems, shelving units and cabinets. Click here for a list of the all 181 exclusion items.

The List 3 exclusions apply retroactively to September 24, 2018 and are in effect until to August 7, 2020. Importers, brokers, and other filers are instructed to use HTS subheading 9903.88.43 for the exclusions as directed in CSMS #4181055 , unless covered by HTS 9903.88.37 .

Section 301 duties will be available in the Automated Commercial Environment (ACE) as of 7 am eastern time, March 31, 2020.

New List 4A Exclusions

On March 30, 2020 the USTR published a notice (85 FR 17936) granting exclusions on 12 List 4A items. These will apply retroactively to September 1, 2019 and are in effect until September 20, 2020. Included are ice bags, refillable dispensers designed for mounting, coverings of plastics and sterile urology drain bags. These too are included on our comprehensive list of published exclusions.

REMINDER List 1 – June 2019 Exclusion Extensions

Due by April 30, 2020

The USTR published a public inspection document in the Federal Register notice on March 20, 2020 (85 FR 16181) announcing it will begin accepting exclusion extension requests for List 1 exclusions granted June 2019 (84 FR 25895 of 06/04/2019). The portal will be open April 1, 2020 through April 30, 2020.

Visit the Tuttle Law website site for the comprehensive EXCLUSION LIST, which includes all exclusions granted, those HTS numbers which are no longer excluded, technical amendments, and corrections to typographic and/or ministerial errors to date.

If you have questions about filing an exclusion request, seeking a refund of past duties paid under Sec. 301, and/or discussing Sec. 301 duty avoidance strategies, such as use of Country of Origin transference or use of “First Sale” valuation, contact Adrienne Braumiller, adrienne@braumillerlaw.com.

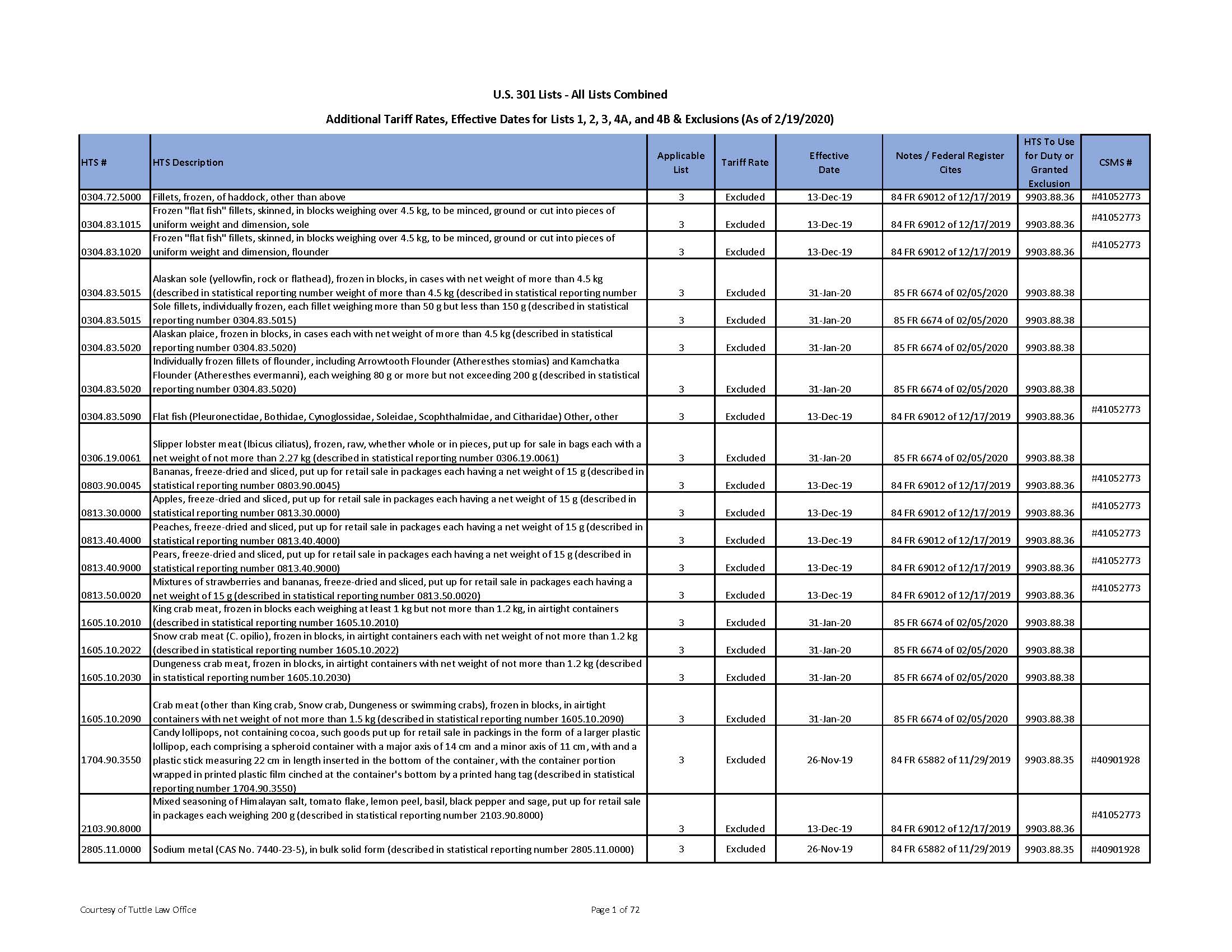

Section 301 Exclusion Requests Granted by the USTR as of February 19, 2020

To view the entire list, please click here or on the image above.

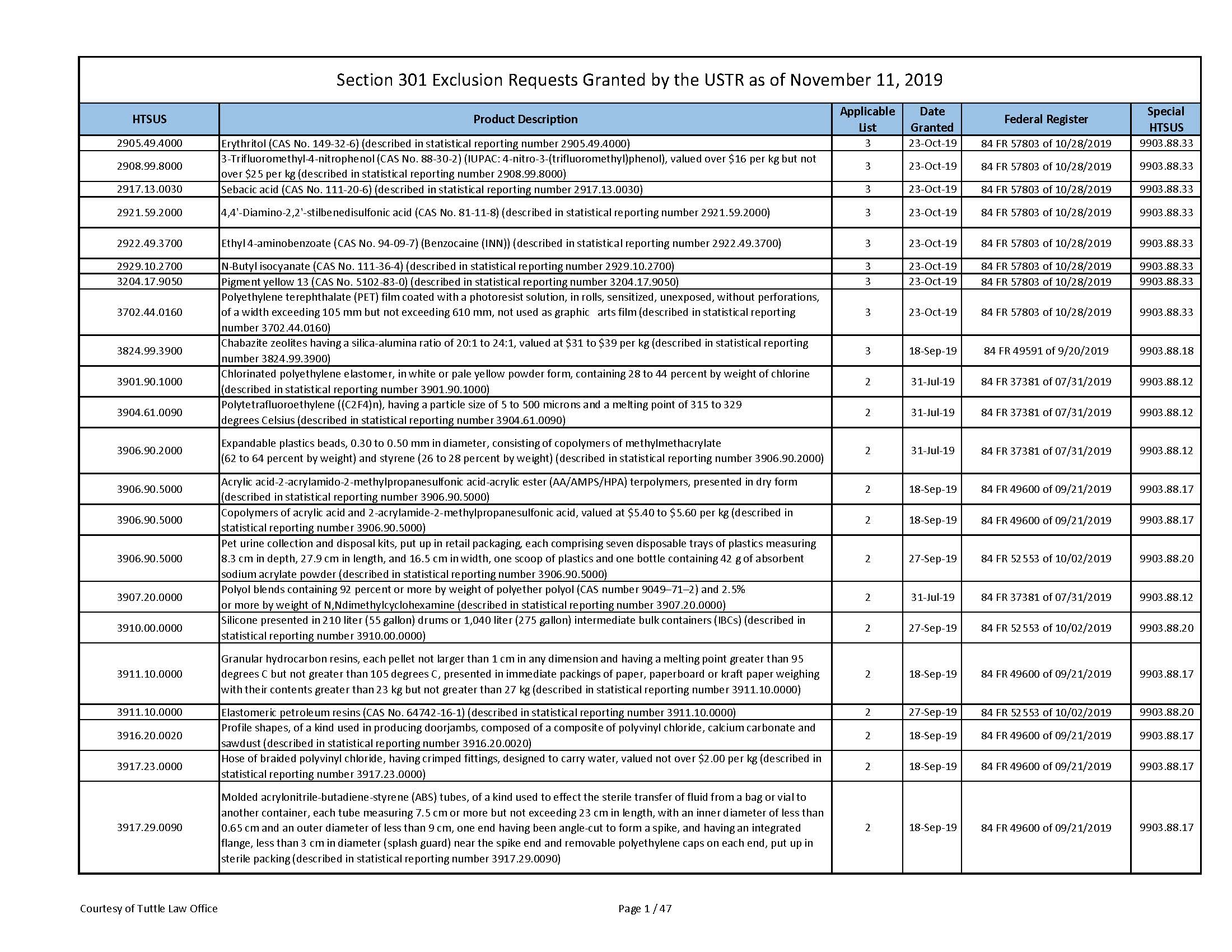

Section 301 Exclusion Requests Granted by the USTR as of November 11, 2019

To view the entire list, please click here or on the image above.

USTR Announces List 4A Exclusion Process

On October 18th, the USTR confirmed that List 4A Exclusion Requests can be submitted starting October 31, 2019, at noon EDT. The deadline to submit requests is January 31, 2020. The USTR has not released a process for requesting exclusions for List 4B. Interested parties have an opportunity to submit an individualized case to the government in an attempt to have their products excluded from additional tariffs. In short, the USTR will be looking for whether the products can be sourced outside of China, whether the imposition of additional duties will cause severe economic harm, and whether the product is strategically related to the “Made in China 2025” initiative. Any exclusion will be effective starting from September 1, 2019, and will extend one year after the publication of the exclusion determination in the Federal Register.

Third Round of Products Excluded from List 3 Section 301 Duties

On October 23, 2019, the USTR issued the third round of product exclusions for the 3rd tranche of Section 301 duties. These exclusions are retroactive to September 24, 2018, and will apply until August 7, 2020.

As set out in the Annex, the exclusions are reflected in 83 specially prepared product descriptions, which cover 95 separate exclusion requests. In accordance with the June 24 notice, the exclusions are available for any products that meet the description in the Annex, regardless of whether the importer filed an exclusion request. Additionally, the scope of each exclusion is governed by the scope of the product descriptions in the Annex, and not by the product descriptions set out in any particular request for exclusion.

U.S. Customs and Border Protection will issue instructions on entry guidance and implementation at a later date.

China and the U.S. reach Preliminary “Phase One” Deal

On November 11, 2019, President Trump and Chinese negotiators reached a preliminary agreement that will ease trade tensions marking the first tangible achievement in their 18-month trade war.

This agreement provides relief mainly to American business and farmers that have been effected by the trade war. The accord would result in an additional $40 billion to $50 billion in farm purchases by China that could officially be signed by November.

In exchange, the U.S. will not move ahead with plans to raise tariffs on $250 billion worth of Chinese goods to 30 percent. President Trump has not made a final decision on whether to impose an additional round of tariffs on Dec. 15.

Stay tuned for more information …

President Trump Announces List 4 Tariffs Beginning on September 1

As a result of Beijing’s trade retaliation, President Trump has said he will be further increasing tariffs on Chinese imports. Trump tweeted, “China should not have put new Tariffs on 75 BILLION DOLLARS of United States product (politically motivated!).” The List 1 and List 2 duties will increase from 25% to 30% beginning on October 1, while the List 3 duties will be 15% rather than 10% on September 1. The US and China were supposed to meet in Washington next month – the status of this meeting is unclear after the latest retaliations.

Trump additionally tweeted that he “hereby ordered” US companies to find alternatives outside of China moving forward. It is unclear which authority the President could rely on for implementing that type of order.

The Chinese Finance Ministry announced that some of the retaliatory tariffs will go into effect on September 1, while the remainder will go into effect on December 15. These dates are identical to when the two List 3 tariff lists will be implemented. China has decided to put an extra 5% tariff on American soybeans and crude-oil imports starting next month. Additionally, China will be resuming the 25% duty on US cars beginning on December 15, with some vehicles including an additional 10% tariff.

Seventh Round of Products Excluded from Section 301 Duties

On August 2, CBP issued the first round of product exclusions for the 2nd tranche of Section 301 duties. These exclusions are retroactive for imports on or after August 23, 2018.

Below are instructions provided by CBP (84 FR 37381) for submitting entries containing products granted exclusions:

- In addition to reporting the regular Chapters 39, 84, 85, 86, 87 and 90 classifications of the HTSUS for the imported merchandise, importers shall report the HTSUS classification 9903.88.12 (Articles the product of China, as provided for in U.S. note 20(o) to this subchapter, each covered by an exclusion granted by the U.S. Trade Representative) for imported merchandise subject to the exclusion;

- Importers shall not submit the corresponding Chapter 99 HTS number for the Section 301 duties when HTS 9903.88.12 is submitted.

Similar to List 1, if an importer has a product that falls on a Product Exclusion list, they can file a Post Summary Correction (PSC) if within the PSC filing timeframe. If the entry is beyond the PSC filing timeframe, importers may file a protest.

Imports which have been granted a product exclusion that are not subject to the Section 301 duties, are not covered by Foreign Trade Zone (FTZ) provisions of the Section 301 Federal Register notices. Rather, they are subject to the FTZ provisions in 19 C.F.R. Part 146.

USTR Issues Product Exclusions From Third Tranche of Section 301 Tariffs

On August 5, the USTR has released its first Product Exclusions for Section – List 3. The new exclusions from the tariffs include “10 specially prepared product descriptions” and cover 15 separate requests, according to the notice. The product exclusions apply retroactively to Sept. 24, 2018 (the initial 10% tariff), and are valid for one year after the notice is published in the Federal Register.

For more information:

Foreign Tariff Responses to U.S. Section 232 Steel and Aluminum Tariffs

A number of countries and U.S. trading partners have imposed or announced their intent to impose retaliatory tariffs on specific exports from the United States in response to the United States’ Section 232 tariffs on steel and aluminum imports into the United States.

To assist U.S. companies in identifying those exports impacted by retaliatory tariffs, the Department of Commerce’s Industry & Analysis unit has compiled a Retaliation Product Coverage Matrix and retaliation information.

Retaliation Product Coverage Matrix

This matrix lists the U.S. goods subject to announced foreign retaliatory measures and includes direct links for U.S. businesses to find additional detail regarding the scope of the foreign measures.

Canada

On July 1, 2018, Canada began imposing additional tariffs of 10 or 25 percentage points on selected U.S. products.

The United States believes that Canada’s retaliatory tariffs are inconsistent with World Trade Organization (WTO) rules and has opposed them at the WTO.

See Official Notification from Canada: https://www.fin.gc.ca/access/tt-it/cacsap-cmpcaa-1-eng.asp

China

On April 2, 2018, China began imposing additional tariffs of 15 or 25 percentage points on selected U.S. products.

The United States believes that China’s retaliatory tariffs are inconsistent with WTO rules and has opposed them at the WTO.

See Official Announcement from China (in Mandarin): http://gss.mof.gov.cn/zhengwuxinxi/zhengcefabu/201804/t20180401_2857769.html

China’s notification to the WTO, which includes a list of tariff codes covered by its retaliatory measures in English, is available here.

European Union

On June 22, 2018, the European Union (EU) began imposing additional tariffs of 25 percentage points on selected U.S. products.

The EU has also announced that it reserves the right to impose additional retaliatory tariffs in three years, beginning in 2021, or earlier if the EU receives a favorable ruling by the WTO Dispute Settlement Body on their claim that the U.S. tariffs constitute a violation of WTO rules.

The United States believes the EU tariffs are inconsistent with WTO rules and has opposed them at the WTO.

See Official Announcement from the European Union: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018R0724&from=

EU’s notification to the WTO, which includes a list of tariff codes covered by its retaliatory measures, is available here.

India

India has announced that, effective August 4, 2018, it will impose retaliatory tariffs of an additional 10, 15, 20, 25, or 50 percentage points on selected U.S. products.

India’s notification to the WTO, which includes a list of tariff codes to be covered by its retaliatory measures, is available here.

Japan

Japan has notified the WTO of its intent to impose retaliatory tariffs on U.S. products. To date, however, it has not provided specific information regarding the scope or timing of its retaliatory measures.

Japan’s notifications to the WTO are available here and here.

Mexico

On June 5, 2018, Mexico began imposing additional tariffs ranging from 7 to 25 percentage points on selected U.S. products.

The United States believes that Mexico’s retaliatory tariffs are inconsistent with WTO rules and has opposed them at the WTO.

See Mexico’s Official Notification (in Spanish): http://www.dof.gob.mx/nota_detalle.php?codigo=5525036&fecha=05/06/2018

Russia

On July 6, 2018, Russia announced that they will impose additional tariffs of additional 25, 30, 35, or 40 percentage points on selected U.S. products. The additional tariffs are scheduled to take effect 30 days from the July 6th announcement.

See Russia’s Official Notification (in Russian): http://government.ru/docs/33173/

Russia’s notification to the WTO is available here.

Turkey

On June 21, 2018, Turkey began imposing additional tariffs on selected U.S. products. On August 15, 2018, Turkey announced an increase in the additional tariff rates, ranging from 4 to 140 percent.

The United States believes that Turkey’s retaliatory tariffs are inconsistent with WTO rules and has opposed them at the WTO.

See Turkey’s Official Notifications (in Turkish): http://www.resmigazete.gov.tr/eskiler/2018/06/20180625M1-30.pdf http://www.resmigazete.gov.tr/main.aspx?home=http://www.resmigazete.gov.tr/eskiler/2018/08/20180815.htm&main=http://www.resmigazete.gov.tr/eskiler/2018/08/20180815.htm

Turkey’s notification to the WTO, which includes a list of tariff codes covered by its retaliatory measures in English, is available here.

Additional Information

To the extent retaliatory measures impact agriculture exports, please consult the U.S. Department of Agriculture’s Global Agriculture Information Network (GAIN) reports at https://gain.fas.usda.gov/Lists/Advanced%20Search/AllItems.aspx.

Norway and Switzerland have also requested consultations with the United States, as part of WTO dispute settlement proceedings, on the U.S. Section 232 tariffs on imports of steel and aluminum into the United States. To date, these countries have not announced their intent to impose retaliatory tariffs.

Disclaimer:

The information set forth above regarding foreign retaliatory measures, including the Retaliation Product Coverage Matrix, has been provided as a public service for general reference. Every effort has been made to ensure that the information presented is complete and accurate as of September 18, 2018. The information will be updated as new developments occur.

The actual tariff classification and assessment of duties is determined by customs authorities in the relevant foreign country. Moreover, countries may elect to increase tariffs or otherwise amend tariff treatment at any time. For definitive guidance, parties should contact the government customs agency in the appropriate foreign country.