On June 8, 2017, U.S. Customs and Border Protection (CBP) distributed CSMS 17-000110 concerning the resubmission of protests for post importation preference claims that were previously rejected as non-protestable. The message stated that, pursuant to the Court of International Trade (CIT) decision in Zojirushi American Corp v. U.S., Slip Op. 16-78 (August 4, 2016), CBP is permitting the use of the protest mechanism set forth in section 19 U.S.C. § 1514 for those Preference Programs (e.g. Free Trade Agreements) and Special Trade Legislation programs that do not have the statutory post-importation mechanism set forth under 19 U.S.C. § 1520(d).

If the original protest submission claiming preferential tariff treatment was rejected as non-protestable, protestants may request reliquidation of the entry through a new protest, or through a letter, which should include the following:

- Statement that this a resubmission of a previous preference claim that was rejected as non-protestable.

- Copy of the original protest showing that it was rejected as non-protestable.

- Certification of origin (or data elements) for the tariff-shift model FTAs that are subject to section 514:

- Australia FTA (AUFA) and

- Singapore FTA (SGFTA).

- Affidavit in lieu of a certification of origin for the following Free Trade Agreements:

- Bahrain FTA (BHFTA),

- Israel FTA (ILFTA),

- Jordan FTA (JOFTA), and

- Morocco FTA (MAFTA).

- Affidavit in lieu of a certification of origin for the following Special Trade Legislation programs:

- African Growth Opportunity Act (AGOA),

- Caribbean Basin Economic Recovery Act (CBERA),

- Caribbean Basin Trade Partnership Act (CBTPA),

- Civil Aircraft Agreement (CAA),

- Generalized System of Preferences (GSP),

- Insular Possessions,

- Intermediate Chemicals for Dyes (Intermediate Chemicals), and

- Agreement on Trade in Pharmaceutical Products (Pharma), etc.

Protestants who wish to have their protests reconsidered must resubmit their protests within 180 days of the issuance of the February 15, 2017 memorandum, i.e. on or about August 14, 2017. Protests may be resubmitted electronically through the ACE protest module, or by paper, to the CBP port of entry. In the message, CBP also indicated that unliquidated entries under the aforementioned programs may still be processed in accordance with current Post Entry Amendment (PEA) and Post Summary Correction (PSC) procedures.

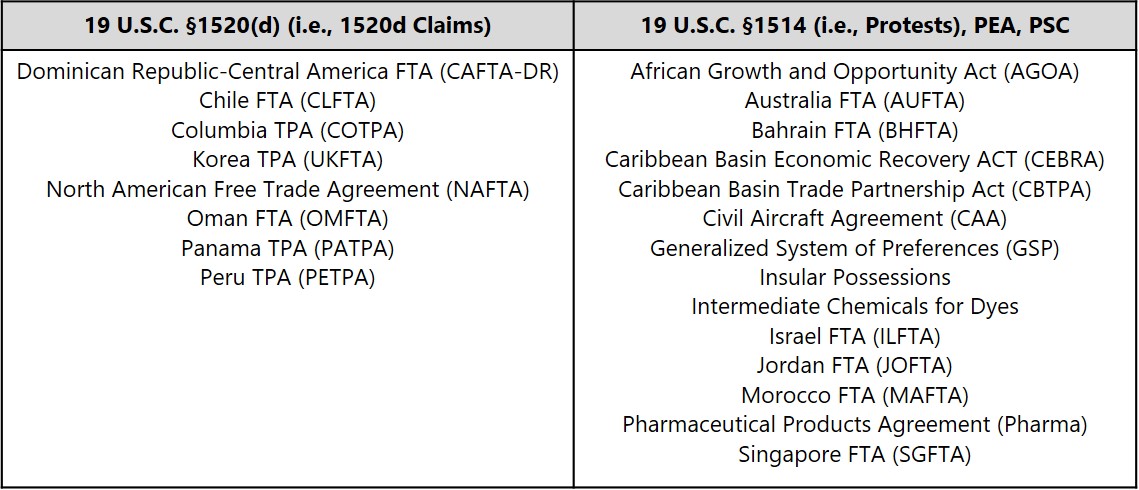

Below is a table of the existing preference programs and the method by which a claim may now be made after importations. For preference programs that by law have a post importation provision, a 1520(d) post-importation claim remains the only appropriate mechanism to seek preference when not claimed at the time of importation.

For questions regarding post importation claims, or any other U.S. import-related matters, please contact Adrienne Braumiller (Adrienne@braumillerlaw.soogreat.com) or Vicky Wu (Vicky@braumillerlaw.soogreat.com).

By: Vicky Wu, Associate Attorney