By Brenda Cordova, Mexico Attorney

In Mexico, the Administración Central de Auditoría de Operaciones de Comercio Exterior from the Servicio de Administración Tributaria is starting to audit and enforce the application of North American Free Trade Agreement (NAFTA) article 303 against those companies participatimg in Industria Manufacturera, Maquiladora y de Servicios de Exportacion (IMMEX).

IMMEX is a duty deferral program created by the Mexican government to attract foreign investment into Mexico. An IMMEX can temporarily import into Mexico materials and assets to manufacture, transform, and/or repair a finished product for subsequent export. As long as an IMMEX complies with specific legal and administrative requirements, including statutory periods of time, it may receive benefits. For example, it is allowed to defer or waive the payment of the import duty applicable to the materials and assets it uses. However, because of NAFTA, some IMMEX may have restrictions on the deferral of the import duties on materials originating outside of Mexico, Canada and the U.S. (the NAFTA countries). The reason: Article 303 restricts the benefits to materials originating outside NAFTA because this treaty is aimed to protect only materials and goods originating within the NAFTA region.

This restriction is set forth under NAFTA article 303, which states that when an IMMEX imports non-NAFTA originating materials into Mexico to be used in the production of finished goods for export to another NAFTA country, the IMMEX must pay duties on the non-NAFTA originating materials. The IMMEX may not receive a deferment of duty liability that exceeds the lesser of: a) the import duties on the imported materials into Mexico, or b) the import duties payable to the NAFTA country of destination of the finished goods. This rule is commonly referred to as the “lesser of the two” rule.

To determine if NAFTA article 303 applies to an IMMEX, it is necessary to first know the:

- Origin of materials

- Country of final destination of the finished good

- Import duty in Mexico applicable to the materials

- Import duty in the U.S. or Canada applicable to the finished

And the IMMEX must gather pertinent documents and information such as:

- Value declared on the materials imported in Mexico

- Value of the finished good declared in the U.S.

- Invoices

- Transportation, labor, and administrative costs

- Bill of materials

- Contracts with suppliers

- Contract with customers

- Mexican HTS code for each material

- Canadian or U.S. HTS code for the finished good

- “Pedimento de importacion” (similar to the U.S. entry summary)

The following is an example of how article 303 could be applied to a company. Please be aware that this is just an example. The application and interpretation of this article may vary depending on the company’s operations and a multitude of other factors. Before you apply this article to your particular company’s operations, I recommend you ask for the advice and help of an expert.

Example:

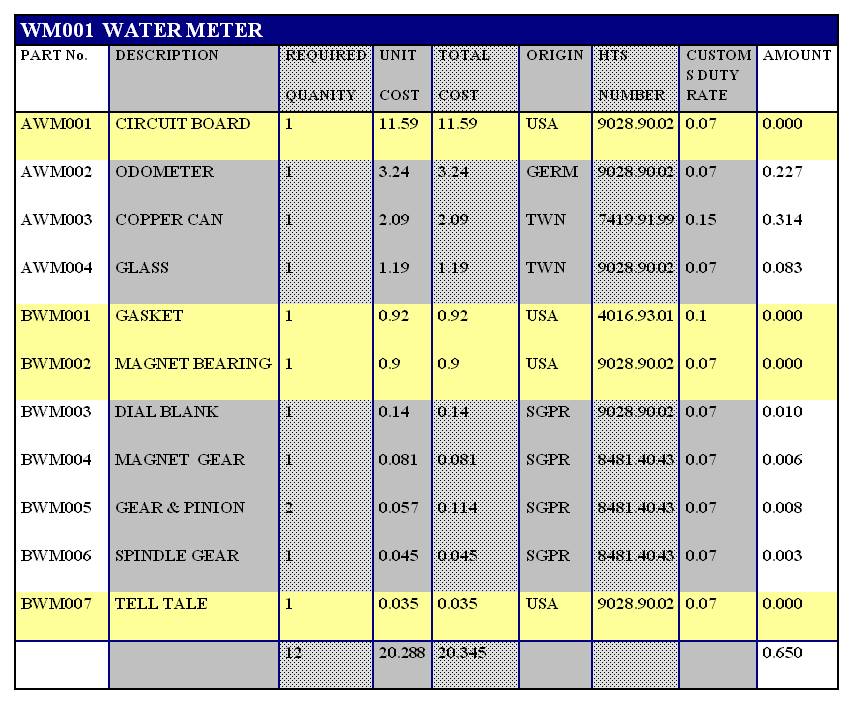

In Mexico, an IMMEX, imports materials from different parts of the world to manufacture water meters. The final destination of its water meter is the U.S. For the purposes of this example:

- Materials are NAFTA (USA) and non-NAFTA (GERM, TWN, SGPR)

- After transforming them into the water meter, it qualifies as NAFTA originating

- In Mexico, the import duty for the non-NAFTA materials is $ 0.650

- The water meter unit cost is $24.30

- In the U.S., the import duty rate for the water meter is 0 %

- The bill of materials is the following:

To apply the Article 303 formula we need to determine two import duties:

a) For the non NAFTA materials imported into Mexico ($0.650), and

b) For the finished goods imported into the US ($0)

Even though the non-NAFTA materials were imported into Mexico by an IMMEX, the duty deferral benefit is restricted to the amount that exceeds the lesser of the two above import duties. This means that the duty deferral benefit will not apply to highest import duty, which is $0.650, and therefore, the IMMEX must pay this amount. This applies as long as the IMMEX evidences with a NAFTA certificate that the U.S. materials are NAFTA originating, otherwise, the IMMEX will be required to pay more duties in Mexico or in the U.S.

As its choice, the IMMEX may pay the duties in Mexico:

a) At the time of importing the non-NAFTA materials into Mexico;

b) At the time of exporting the finished goods to the U.S.; or

c) Within 60 days after the finished goods were exported from Mexico.

If the water meter were to be shipped to countries other than Mexico, Canada or the U.S., article 303 would not apply, and the duty deferral benefit will not be restricted.

In Mexico, the corresponding Mexican authorities are starting to audit this type of operation. Therefore, if you are conducting business with an IMMEX, make sure that all of the involved parties are implementing article 303 correctly. Otherwise, sanctions might be imposed against an IMMEX.