It’s a matter of “Much ado about something. . .”

Make no mistake – denied party screening applies to you. Don’t gamble with your export privileges by thinking “one size fits all” when it comes to screening. Instead, consider the principle of “screening smart”. Take into account your business model and incorporate the Best Practices factors that will fit your organization’s needs.

Denied & Restricted Parties – Best Practice Breakout

U.S. government agencies as well as international organizations and foreign government agencies publish lists of entities and companies that are denied or restricted from doing business with a US affiliated company. In the event a company, entity or person on one of such lists appears to match a potential party in an export transaction, additional due diligence is required before proceeding. Typically, depending on which list the match was found, it is recommended that companies and organizations should consult the requirements of the specific list on which the company, entity or person is identified by reviewing the Federal Register Entry and Agency rules for that particular list prior to taking any further actions. Violation of the regulations can cause criminal and administrative penalties against the companies and organizations. Moreover, violators may be subject to denial of their export privileges, which essentially means the company is prohibited from participating in any future transactions.

The license exceptions that can generally be applied to export transactions, in most instances, are not available for use if the party is listed on the denied party lists. Rather, such transactions require an export license and are usually subject to a policy of denial.

Screening Process

Ensuring the end-user or recipient of the to-be-exported products, software and technical data, is not listed in the denied and sanctioned party lists is the only way to diminish the risk of violation to the export control regulations. The practice is commonly called “Denied/Restricted Party Screening” and is achieved by processing the name of persons and entities against the governmental lists and identifying any possible matches prior to an export or a business activity.

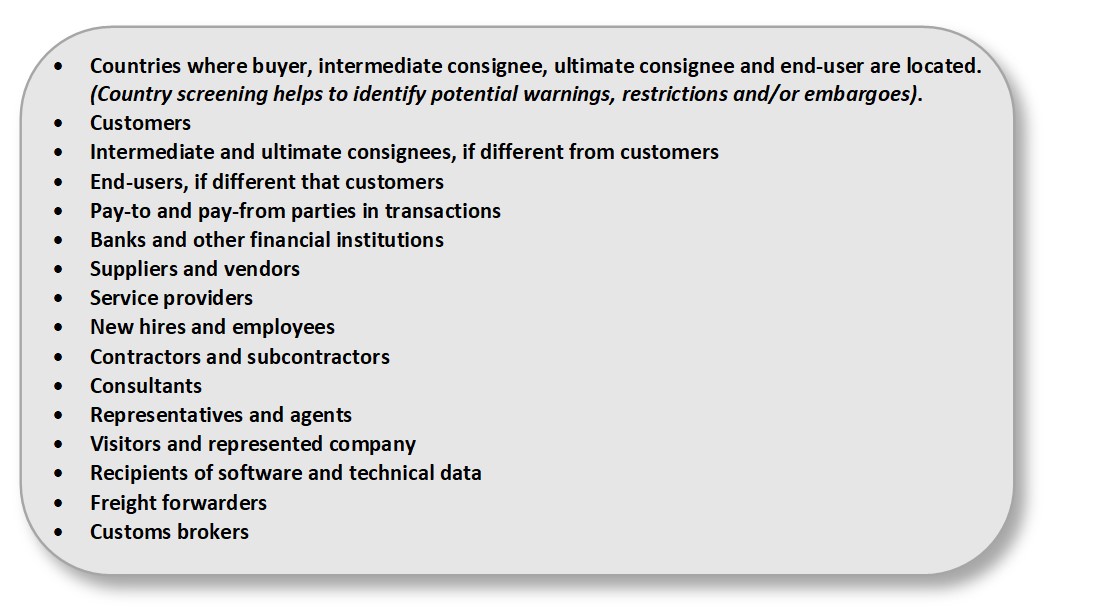

Identifies Who Needs to be Screened

Based on best practices, organizations should follow the screening process below:

Again – based on best practices, these parties should be identified within a particular transaction and screened. It is not always possible to make a full determination of participating parties, but those that can be identified should be screened. You will notice that the list above is not necessarily a “transaction” based list. Certain items like employees, contractors and brokers should be addressed from the perspective of the company interaction.

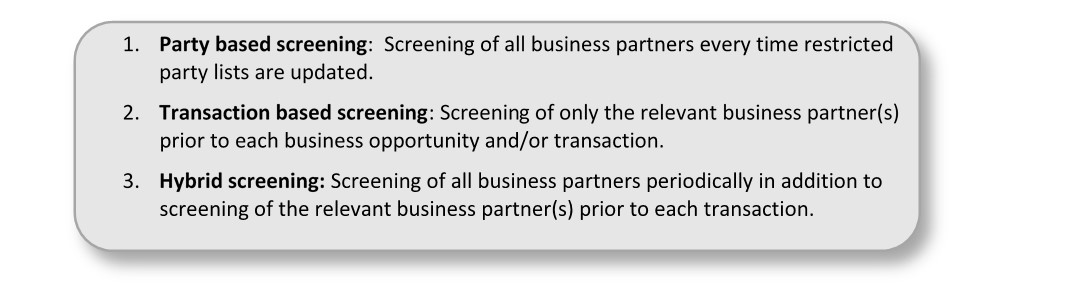

Identify a Screening Process

Screening activity typically involves searching for name and address matches of the identified trade entities. Since the watch lists are subject to frequent changes that are often effective immediately, screening is essentially a repetitive task. The best practices in the industry today recommend three basic approaches in regard to the timing and nature of the screening.

Considering the fact that the most up-to-date restricted party lists should be used for any approach, screening can be manually intensive work. In cases with the existence of a large amount of trade partners, using a software solution is inevitable. Automated software usually has the ability to employ a “fuzzy logic” algorithm, which searches for similar sounding names or phonetic matches in order to account for differences in native alphabets and foreign entity lists.

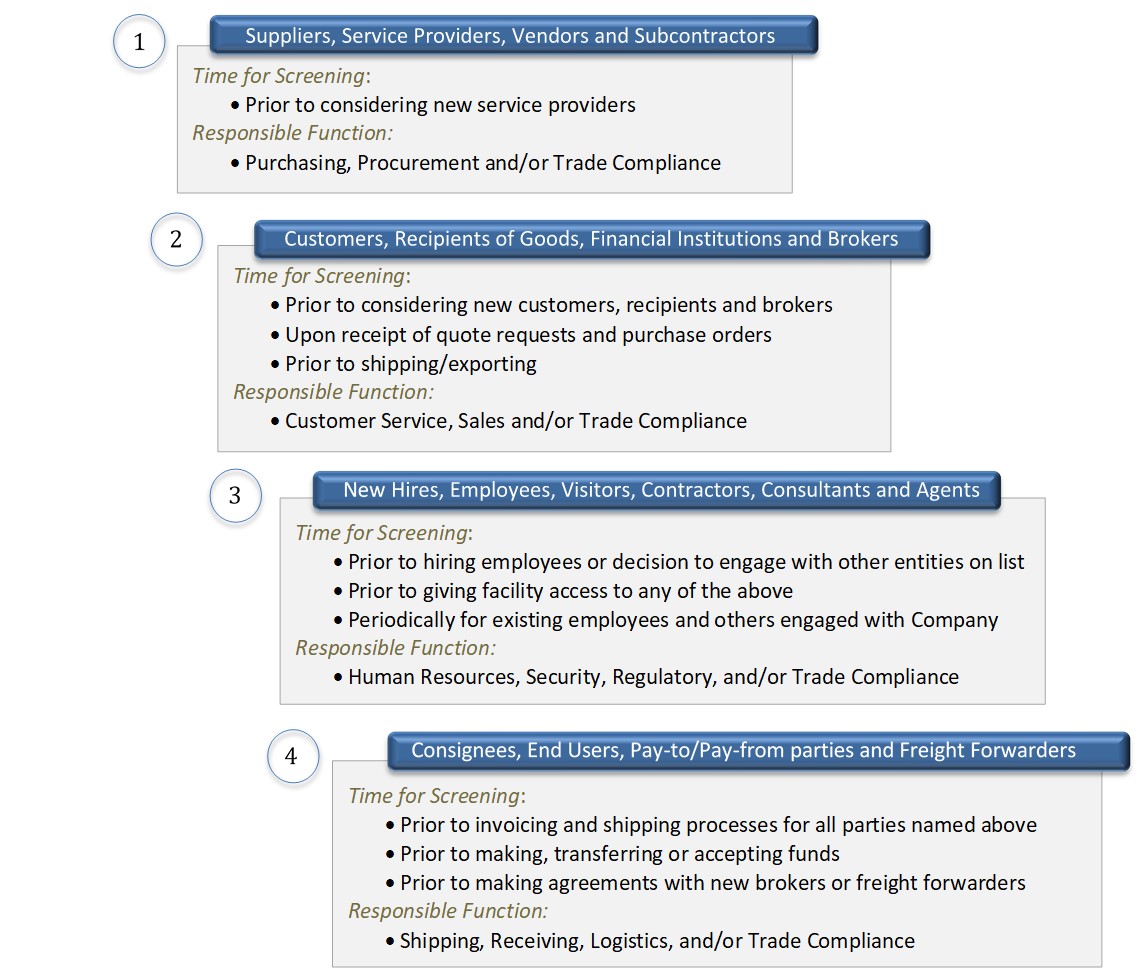

The following is a full breakdown of Best Practices in Timing and Responsible Functions. This outline should be adapted to best facilitate the evaluating Company and operational functions within that Company.

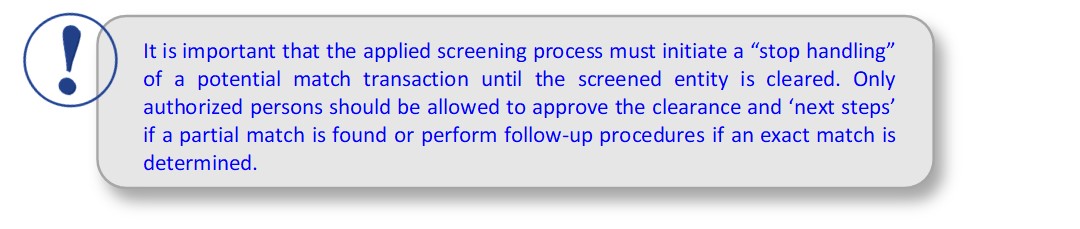

Screening Results – What to Do?

No match is found: Depending on the screening method selected, if no match to the screened entity is found – Green Flag – proceed with process.

Partial matches are found: If a percentage match above 80% is found, ensure that the screened entity is not the same entity as any of those partial matches. This can be verified by reviewing name and/or address variances between the screened entity and found matches. Often it will be necessary to further review the other information listed, such as other names (e.g. aka), addresses, date of birth and identity information of the partially matched entities.

Exact matches are found: Similar to a partial match, screening person and authorized individuals must review the matching fields and additional information on listed entities and confirm the match. Once confirmed, organization must stop processing the transaction and execute further analysis of the nature of the business transaction.

Entities might be sanctioned for all types of or for certain types of transactions by the listing agency. Depending on the restriction type and legal jurisdiction, it must be determined if an export authorization license can be secured prior to transaction initiation, or if the transaction must be abandoned and what the company policy is in this case.

In all above cases, record retention is paramount. Accordingly, it is highly recommended that results of all screening activities along with the clearance approvals by the authorized persons are documented. (Third Party Screening Software will account for audit trail and permissions documentation).

Primary Source:

White paper published by Linqs (formerly, Intredex Trade Compliance Solutions), dated May 2014.

Additional Sources:

Shipping Solutions – Restricted Party Screening; 2019.

eCustoms; The Export Compliance Journal; Blog Post March 2018;

Export Solutions; Blog Digest 2018